Project Phoenix I > 42‑Well Redevelopment

The Phoenix Project redevelops the Sultan Field (NC-129) via the re-entry and optimization of 42 capped wells. Prior drilling confirmed hydrocarbons in the Paleocene dolomite; our phased plan brings wells back online quickly and ties treated crude to the Zuitina terminal while sweetened gas connects to the SOC Brega–Benghazi pipeline.Financing for the modeled project is shown through an illustrative “Project Phoenix Revenue Bond” framework, combining oil-field cash flows with an AI venture component.

- IssuerProject Phoenix I SPV LLC

- SponsorTailored Bonds LLC

- StatusConceptual Model

- StreamsOil revenues + AI returns

- Coupon5% fixed, paid biannually

- Maturity10 years

Area & Facilities

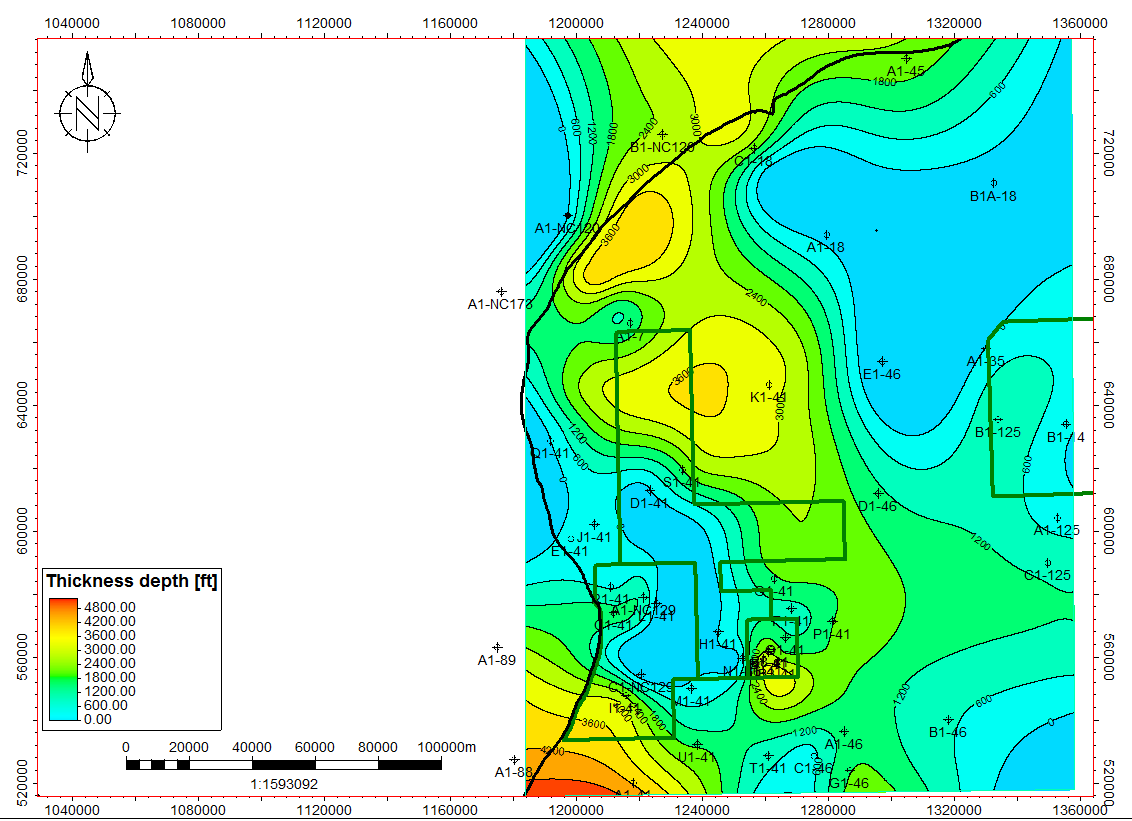

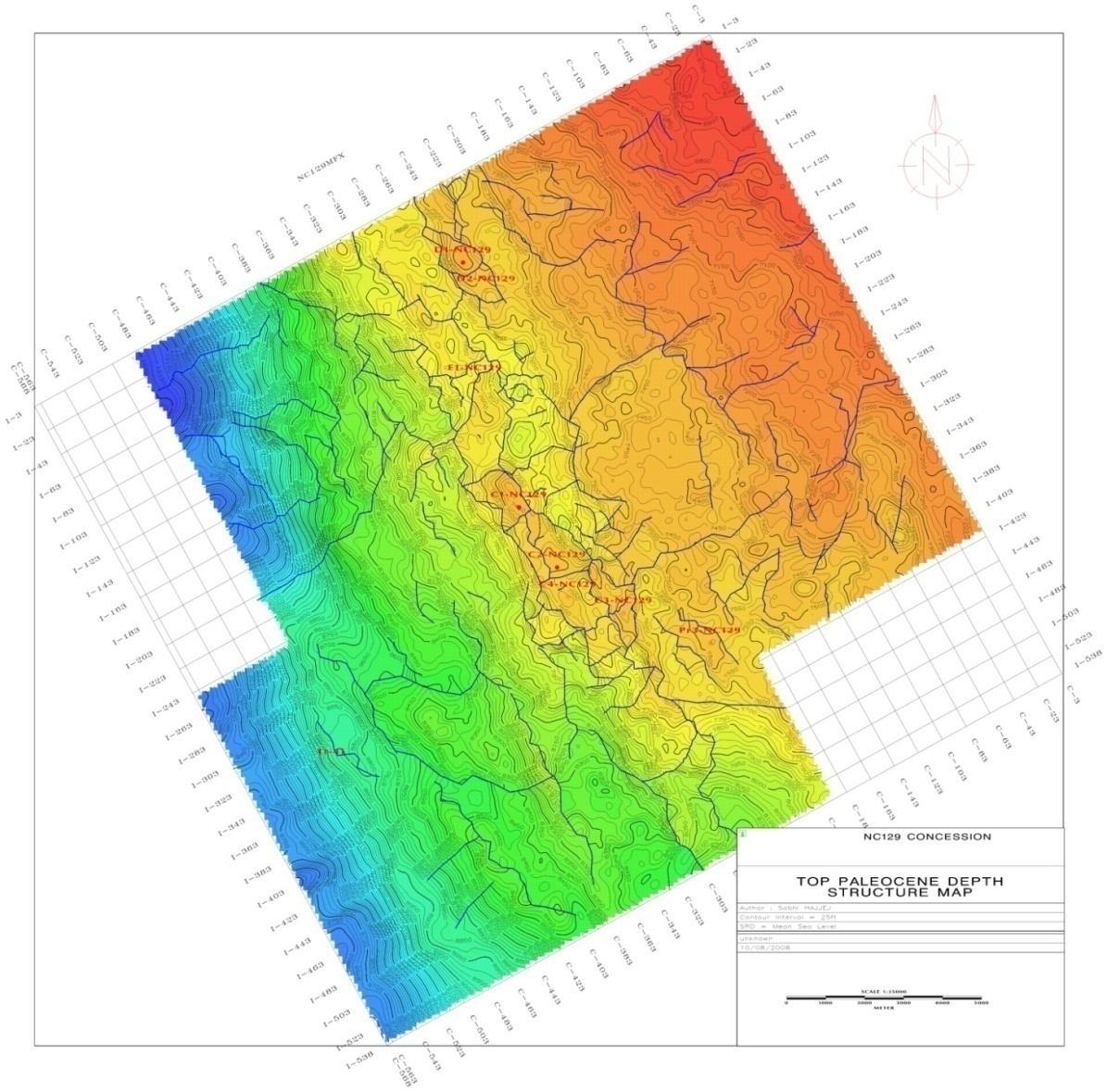

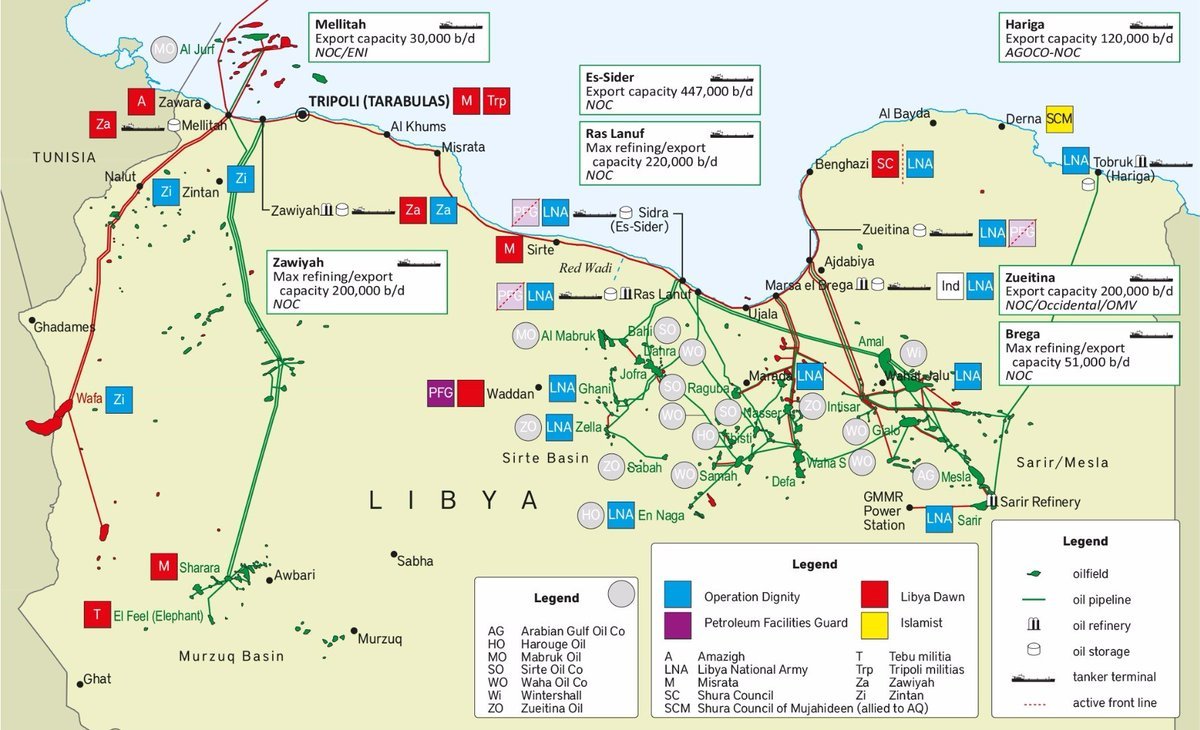

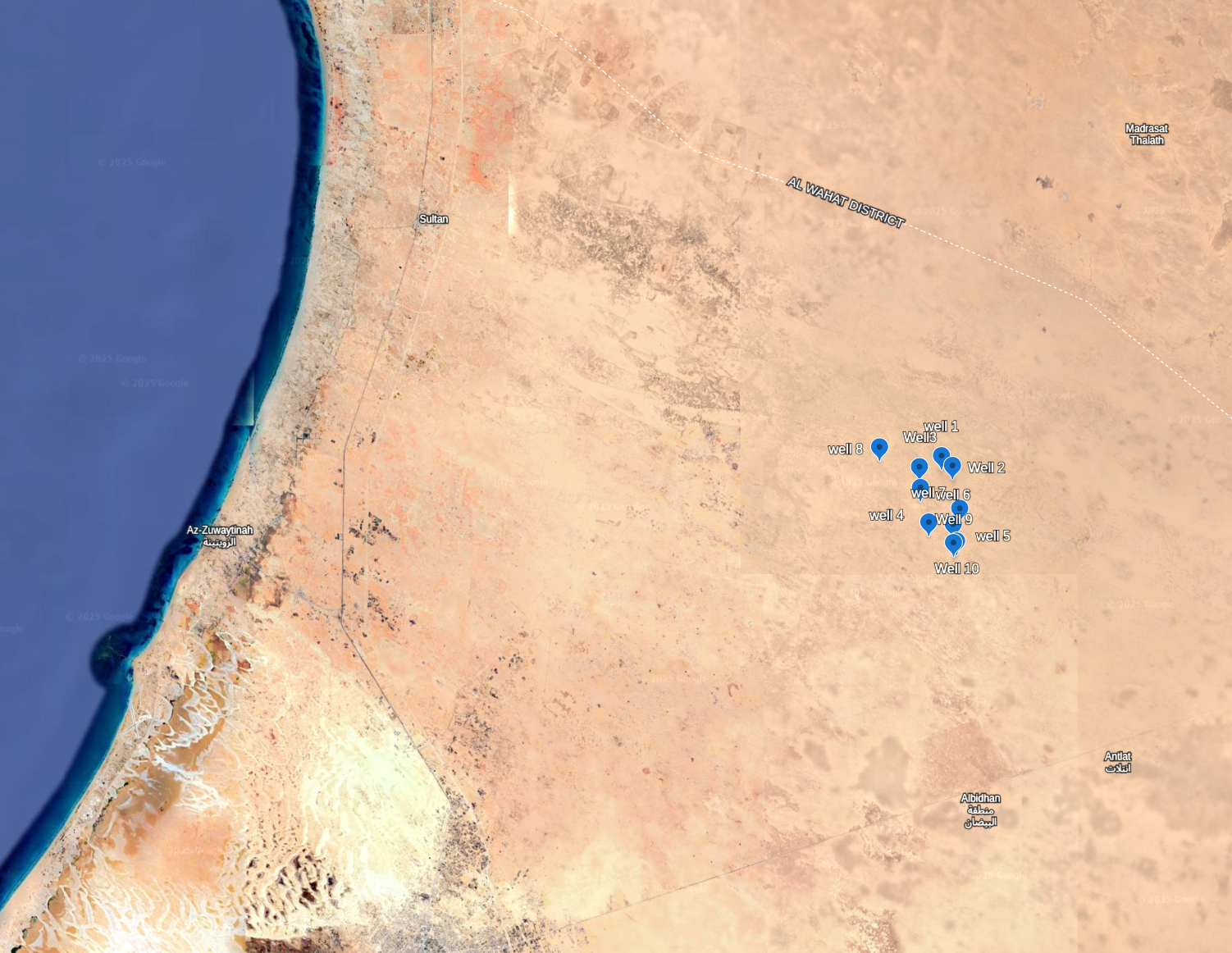

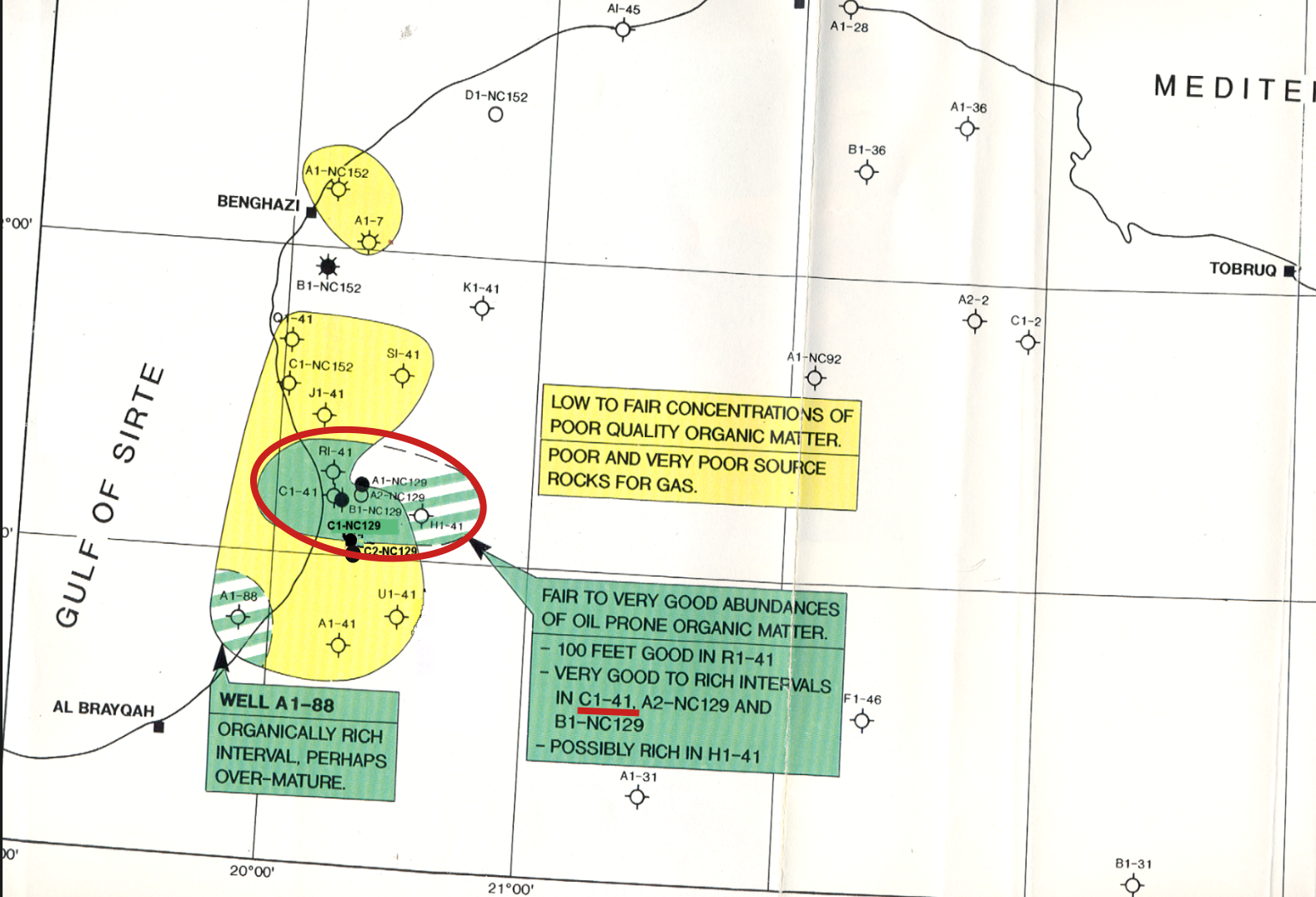

The Phoenix Project is centered on Concession NC-129, known as the Sultan Field, The field was first discovered in 1996 by the Arabian Gulf Oil Company (AGOCO) through the drilling of well C1-NC129, which confirmed hydrocarbons in the Paleocene dolomite reservoir. The concession lies approximately 150 kilometers south of Benghazi and just 35 kilometers northeast of the Zuitina export terminal, with direct access to the SOC Brega–Benghazi gas pipeline. This proximity to established infrastructure allows for rapid evacuation of crude and gas once wells are brought back online.

Production & Offtake

Crude and gas from the Sultan Field will be gathered and separated onsite, then piped directly to regional processing facilities at Zueitina and into the SOC Brega–Benghazi pipeline. With recent Honeywell-supported upgrades to NOC facilities, including sulfur recovery and gas sweetening units, the field can tie into existing capacity rather than requiring a standalone early production facility. Modular separation and pumping units will be installed at the well clusters to ensure flow assurance, with a contingency option to deploy a compact EPF if requested by NOC.

Geology & Reservoir

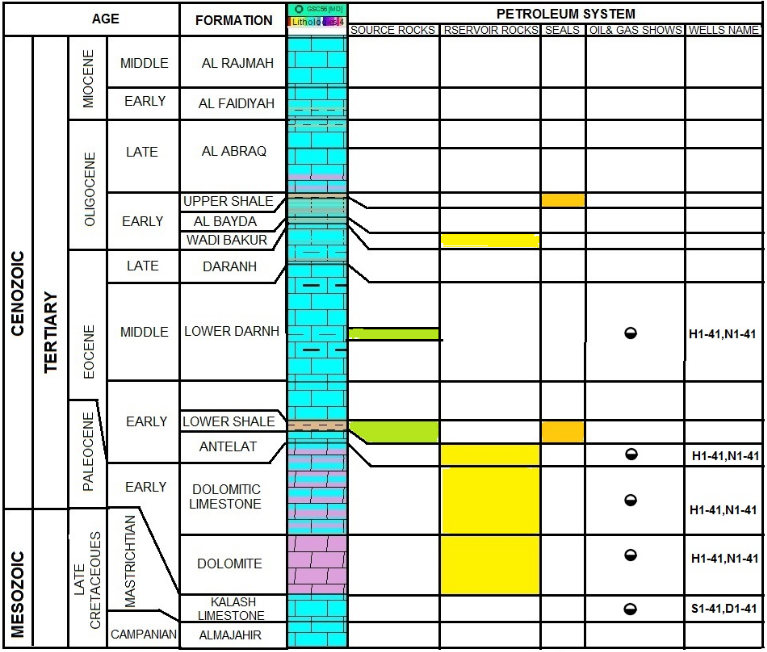

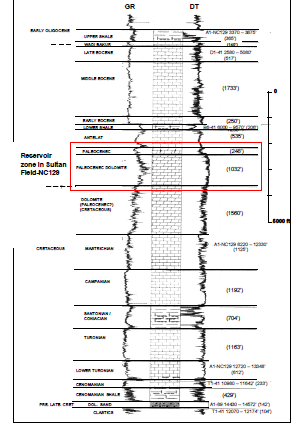

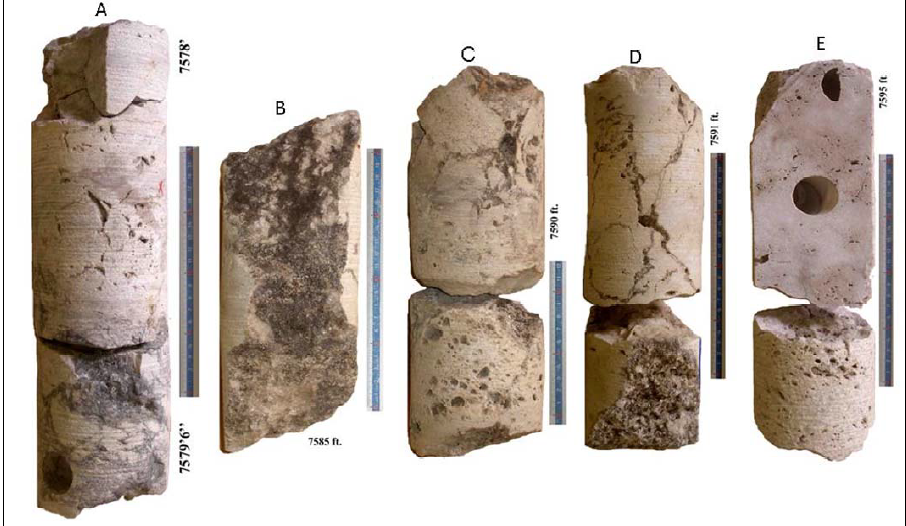

The Sultan Field in Concession NC-129 is geologically positioned on the northeastern margin of the Sirte Basin, within the Solouq Depression. The field’s primary reservoir is the Paleocene dolomite, characterized by dual porosity – both fractured and vuggy – which enhances storage and flow capacity. In the upper 100 feet, porosities of 10–15% and permeability improved by karstification have been consistently measured in cores and logs.

The petroleum system is charged by the Sirte Shale, a prolific Type II kerogen source rock, with migration pathways feeding into NC-129 from the Ajdabiya Trough. Regional seals are provided by Eocene and Oligocene shales, creating effective traps. Trap styles are diverse, including four-way fault-bounded closures and tilted block structures, which have proven effective in retaining hydrocarbons during past drilling campaigns.

The stratigraphic framework highlights the Paleocene dolomite as the most prolific unit, but additional potential exists in the Antelat and Upper Cretaceous horizons. Hydrocarbon shows and flow tests in wells such as C1-NC129 and F-Structure confirm commercial-grade oil and gas within these formations.

Economic & Strategic Rationale

Phoenix prioritizes redevelopment over exploration. Re-entering 42 existing wellbores avoids wildcat risk and shortens time-to-cash: pads, access and penetrations already exist, and prior tests confirmed hydrocarbons in the Paleocene dolomite. That lowers capital intensity per flowing barrel and allows a phased ramp that is tightly coupled to cash generation.

Returns flow from two complementary streams. First, oil & gas production tied to nearby export infrastructure creates secured, predictable cash for debt service. Second, investors participate in a 10% carry on AI ventures, providing asymmetric upside without compromising the base energy cash flows.

Use of Proceeds

| Category | Amount | Share |

|---|

See internal model notes for allocation methodology (illustrative only).

Illustrative AI Carry Simulation (Model Example Only)

Beyond oil, the Phoenix Bonds provide access to VentureSage’s Venture Investment Machine (VIM) — a proprietary “Software as a Financial Service” (SaaFS) platform engineered to unlock high-conviction investments in the fast-growing AI sector. The model structure includes a simulated 10 % carry mechanism to demonstrate AI-linked participation in all realized venture exits from Year 3 onward, offering asymmetric upside that is de-linked from commodity cycles.

The Old Game vs. The VIM Advantage

Traditional VC is founder roulette: nine out of ten bets fail, and survival depends on fund size. We flip that logic. Instead of waiting for founders to raise, the VIM maps markets first and proactively funds companies before the rush. Timing and breadth mean second-tier teams can win with the right capital at the right moment.

- Timing AdvantageAI models flag market inflections before they hit mainstream.

- Deal Flow AdvantageWe source deals proactively, not in overhyped auctions.

- Portfolio AdvantageMultiple winners across tiers, not dependence on one unicorn.

The VIM applies layered AI models and automated deal-sourcing tools to scan, evaluate, and act on opportunities in pre-IPO companies that are reshaping global value chains. This system accelerates investment velocity, ensuring the fund is not constrained by traditional deal-flow bottlenecks.

Venture Investment Machine (VIM)

Path to Sucess:

Market Heat-Map → AI Pre-IPO Analyst → Acquisition Machine → Reputation Mgmt → Exit Machine- Market Heat-MapAI models track emerging AI-driven sectors and map growth curves.

- Pre-IPO AnalystAutomated diligence & valuation scoring of target companies.

- Acquisition MachineDirect outreach and structured offers at disciplined valuations.

- Reputation ManagementStrengthens portfolio brand equity ahead of exits.

- Exit MachineOptimized monetization via IPO, M&A, direct listings, or roll-ups.

AI Venture Carry — Bondholder Upside (Illustrative)

Base case modeled at 3–5× portfolio return. Higher multiples shown for context only. See internal modeling assumptions (illustrative only; no investment forecast).